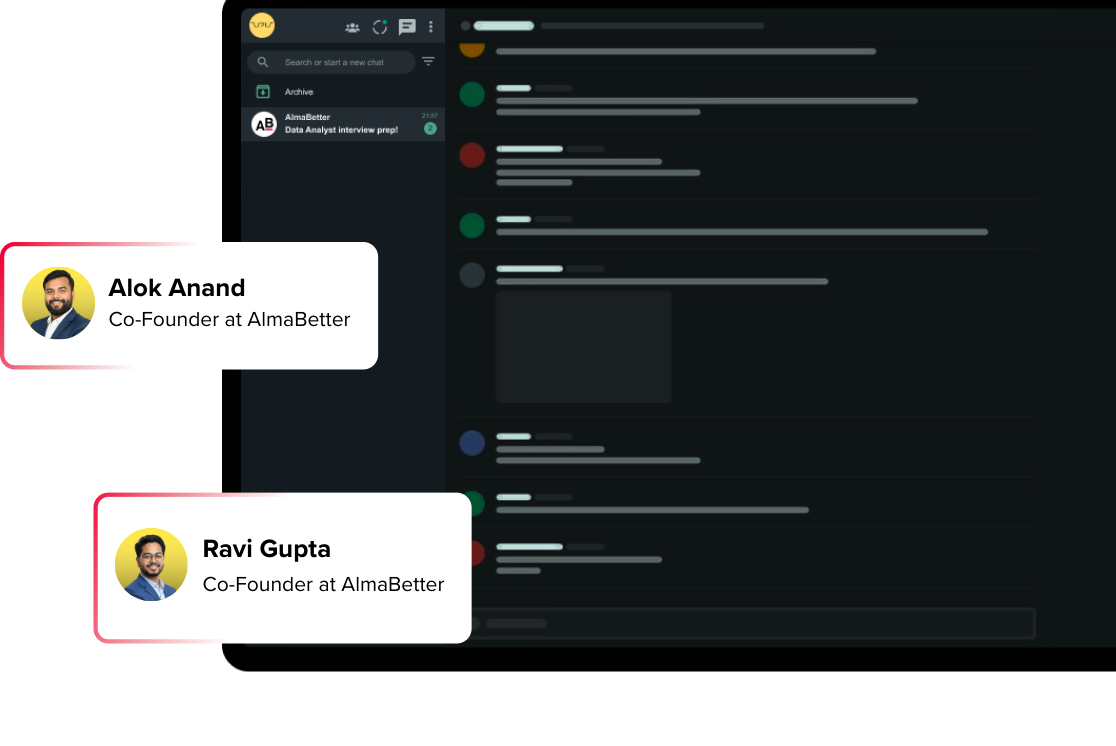

Learning is better with

AlmaBetter Community

Join a community of serious & passionate tech folks, students, mentors and coaches to accelerate your career.

- Courses

- Advanced Certification in Data Analytics & Gen AI Engineering

- Advanced Certification in Web Development & Gen AI Engineering

- MS in Computer Science: Machine Learning and Artificial Intelligence

- MS in Computer Science: Cloud Computing with AI System Design

- Professional Fellowship in Data Science and Agentic AI Engineering

- Professional Fellowship in Software Engineering with AI and DevOps

- Join AlmaBetter

- Sign Up

- Become A Coach

- Coach Login

- Policies

- Privacy Statement

- Terms of Use

- Contact Us

- admissions@almabetter.com

- 08046008400

- Official Address

- 4th floor, 133/2, Janardhan Towers, Residency Road, Bengaluru, Karnataka, 560025

- Communication Address

- Follow Us

© 2025 AlmaBetter